Qualifying Fsa Expenses 2025. Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. So if you have an fsa, you need to use those funds before the year ends.

For 2025, employees can set aside up to $3,200 for healthcare fsas, which they can then use on eligible medical expenses.

Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

List Of Fsa Eligible Expenses 2025 Irs Honey Laurena, Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas. Get clarity on what expenses and items are eligible for fsa coverage with paychex and learn how to maximize your fsa benefits and save on healthcare costs.

List Of Fsa Eligible Expenses 2025 Irs Honey Laurena, Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas. Your company may offer you two options when you use your fsa funds.

Fsa 2025 Eligible Expenses Bella Carroll, A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. Can’t find what you’re looking for?.

What is an FSA? Definition, Eligible Expenses, & More finansdirekt24.se, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. This is a $150 increase from the 2025 limit of $3,050.

Fsa Approved List 2025 jaine ashleigh, Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas. But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

EyeGiene Product Purchases are Qualified FSAHSA Expenses, Budget for care costs, save on taxes. Get clarity on what expenses and items are eligible for fsa coverage with paychex and learn how to maximize your fsa benefits and save on healthcare costs.

2025 Fsa Lacey Minnnie, 6 things to know about fsa compliance. A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account.

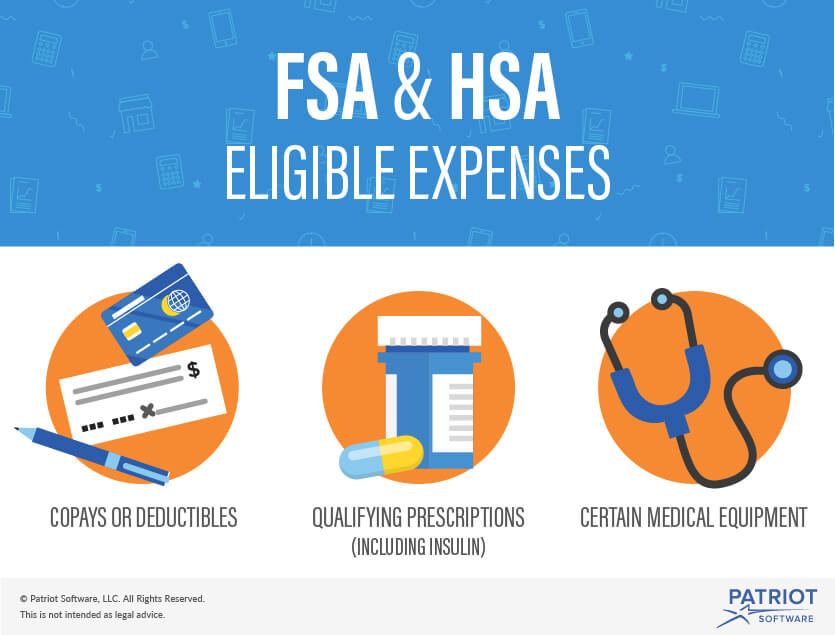

Fsa Qualified Expenses 2025 Elora Honoria, Similar to health savings accounts (hsas),. Common qualified expenses that an fsa will usually cover include the deductible, coinsurance or copayment amounts for your health plan, eyeglasses or contact lenses,.

Eligible Health Care FSA Expenses, Get clarity on what expenses and items are eligible for fsa coverage with paychex and learn how to maximize your fsa benefits and save on healthcare costs. Fsa qualified medical expenses (qme) your fsa may cover your medical expenses like prescription medications and counseling treatment.

Health Fsa Eligible Expenses Doctor Heck, A listing of eligible expenses can be found on the. The internal revenue service (irs) determines what are considered eligible expenses for all flexible spending accounts.

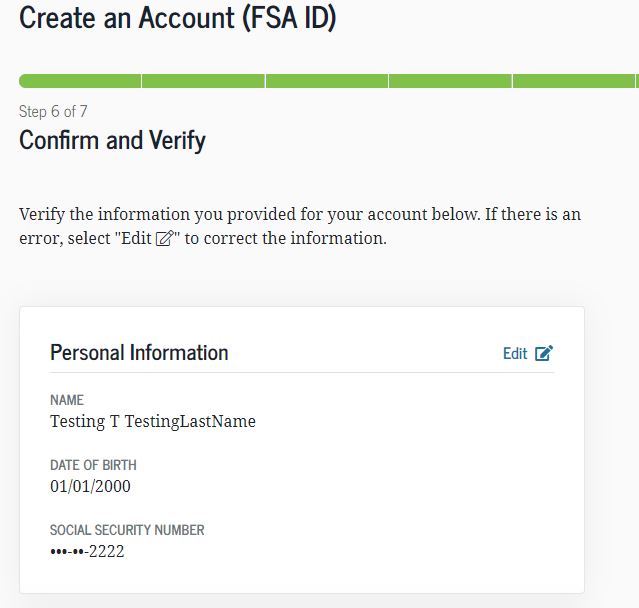

Eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to take advantage of an fsa during 2025.